Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

The Real MFA Payday

Made-for-advertising is far from a solved problem, but buyers aren’t freaking out about it anymore, Digiday reports.

To be fair, they have more pressing concerns. Unlike third-party cookie deprecation, for example, and other intractable technical challenges, MFAs can be avoided by any advertiser motivated to do so. Marketers just have to start paying attention.

In an interesting aside, Digiday quotes an agency buyer from Digitas who mentions that The Trade Desk automatically filters MFA.

TTD has quietly blocked the vast majority of MFAs since long before it became a hot-button issue.

Although some people consider MFA revenue to be an easy, short-term cash grab for demand- and supply-side platforms, TTD’s ability to win and retain accounts was probably helped by the fact that it discreetly avoids that inventory.

Meanwhile, practically every other DSP would partake, even if agencies were unaware of the issue at the time.

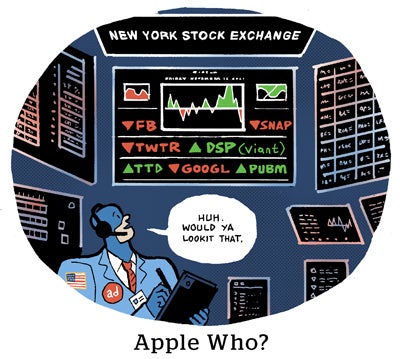

View From The Top

When media analysts meet, they can’t help but talk about Meta and Google.

During a recent episode of Ben Thompson’s Stratechery podcast, digital marketing consultant and investor Eric Seufert declared that he thinks “ATT is in the rear-view mirror” for Meta.

“They’ve adapted fully,” he said, in reference to Meta’s blowout earnings last week.

Although many of the small ecommerce businesses built on Facebook and Instagram have been “hollowed out,” Seufert said, Meta itself is back to its former level of firehose cash flow thanks to server-side integrations and new targeting and measurement systems.

Meta’s ad flywheel doesn’t have to spin like before to dramatically outperform the rest of the market – which it now does. Clearly, Apple’s attempt to knock Meta back to the Stone Age didn’t work.

Google, however, might actually be the one facing an existential risk – if it loses its iron grip on search. ChatGPT, TikTok and Amazon represent serious threats.

At the same time, the next tier of social media, including Pinterest and Snap, are waiting for Facebook, Instagram, Google Search and YouTube feeds to finally reach ad saturation so those budgets can spill into their platforms.

Pack Leader

Publicis Groupe reported 6.3% organic growth in Q4 during its earnings call yesterday.

The company says it’s leapfrogged its peers – both fellow agency holdcos and IT consultancies – by growing and taking share while others shrink.

Media revenue saw double-digit growth, and the Epsilon data business was up by 9.6%. Creative agency revenue, which has been soft for other holdcos, experienced low single-digit growth.

Publicis forecasts 4% to 5% organic growth in 2024, which is bullish for the agency category.

The holdco is also earmarking between 700 million and 800 million euros for “selective M&A” to strengthen its first-party data, AI and marketing personalization.

However, there were but glancing references on the call to Publicis Health’s recent $350 million settlement for its role in the opioid crisis as Purdue Pharma’s ad agency. Presumably, the unseemly news didn’t jibe with the company’s self-congratulatory narrative.

But Wait, There’s More!

Disney invested $1.5 billion in Epic Games to create a “persistent universe” tied to Fortnite. [The Verge]

Is “perfect” the enemy of “good” when it comes to the Privacy Sandbox? [Adweek]

Google is jumping into the tech industry’s latest craze: subscription chatbots. [WSJ]

In other Google news, its Gemini chatbot will retain data from user conversations for three years by default. [TechCrunch]

With a $7 million price tag per Super Bowl ad, brands are trying to build buzz around the Big Game in other ways. [Digiday]

The IAB and MRC publish augmented reality measurement guidelines for public comment. [release]

Confessions of an AI clickbait kingpin. [Wired]

The FCC makes using AI-generated voices in robocalls illegal. [release]

You’re Hired!

Contextual ad company Seedtag hires Kartal Goksel as CTO. [release]

AI-driven brand advertising company LoopMe appoints Rob Cukierman as chief product officer and Brian Bell as GM for North America. [release]