Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

The Sky Bridges

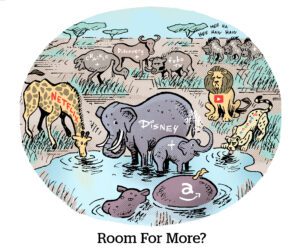

Standalone walled gardens are transforming into an interconnected network of fortresses.

It’s not that walled gardens are opening up, exactly, but individual platforms are now actively partnering to allow one-to-one user targeting and other use cases among themselves – but not for the greater market. These fortresses now have what one might think of as sky bridges that only cast a greater shadow across the open web.

For instance, recipe and cooking sites are up in arms this week because a Google Search ranking tweak suddenly removed many top-performing recipes from the carousels atop search result pages. Google replaced those prized spots mostly with Pinterest recipes, according to Search Engine Roundtable.

Pinterest, by the way, cut a major advertising partnership with Google Ads last week, which now has access as a third-party buyer to Pinterest inventory. It’s a very advantageous deal for Google, and it is Pinterest’s second such deal, following an integration with Amazon last year.

There’s no official connection between Google’s search carousels and its Pinterest ad-buying partnership. But it’s the kind of tit-for-tat dealmaking that’s become commonplace between walled garden platforms.

Walmart’s Vizio-n

While we’re on the subject of walled gardens, Walmart appears to want one of its own.

See Walmart’s reported negotiations to acquire smart TV manufacturer Vizio, which is an advertising and data company as much as it is a TV manufacturer. Vizio has access to IP-address-level viewing data as well as first-party automatic content recognition capabilities to underpin its ad sales.

If Walmart were to acquire Vizio, the deal would remove the retailer’s neutral status in TV sales. Walmart would no doubt want to sell Vizio TVs and could support lower prices. It would also own a sizable chunk of CTV inventory and have automatic distribution for its owned-and-operated media. Today, Walmart must partner to achieve reach outside of its site and app. Paramount+, for example, is included with the Walmart+ membership program.

There’s also the ambition to make T-commerce (yep, T-commerce) a thing. As in, television commerce.

Walmart, with its built-in membership program and saved credit card details, would be well-placed to support shopping through one’s TV.

For more fun speculation about the implications of this potential acquisition, check out the latest Next in Media newsletter from Mike Shields.

Lost in Transition

Dentsu had a grueling year, with a markedly poorer showing than its agency holdco peers, according to Brian Wieser of Madison and Wall.

The company reported its full-year 2023 earnings on Wednesday, and it wasn’t a pretty picture. Although net revenues grew 1.6%, organic growth shrank by 4.9%. In the US, Dentsu saw declines of more than 10% in Q4 and up to 10% for the whole year. Even in its home market of Japan, organic growth was up a meager 0.9% in Q4 and 1.6% for the year.

Contributing to Dentsu’s woes in 2023 were decreased ad spend among finance and tech clients as well as greater competition for ad dollars and (as ever) macroeconomic headwinds.

Internal restructuring might also have led to turmoil. In November 2022, Dentsu hopped aboard the holdco consolidation train with its One Dentsu model, which merged Dentsu International and Dentsu Japan Network into one organization.

The transition hasn’t been smooth thus far, although Dentsu is forecasting approximately 1% organic growth for 2024.

But Wait, There’s More!

Google quietly launches Goose, an internal AI model designed to help employees write code more quickly. [Business Insider]

Lyft shows signs of life after a profitable Q4. [The Information]

Why Snapchat is pitching its platform as an alternative to social media. [Digiday]

You’re Hired!

Henry Olawoye joins Stirista as VP of audience solutions. [release]

Mobile in-game ad platform AdInMo appoints industry veteran John Rankin as CRO. [release]

Zefr promotes Jon Morra to chief AI officer. [release]