Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Volatile Mosaic

One week ago, AdExchanger Daily noted an update to Google Search rankings based on open hours where stores or local services plummet from search result pages when they’re closed.

But it isn’t just local businesses or happening during open hours.

Google Search is whizzing like a seismograph during an earthquake.

“You’d expect that the Google search ranking volatility would calm as we get closer to the holiday break,” writes Barry Schwartz at Search Engine Roundtable. “But no.”

The last confirmed Google Search rankings update was in November, and things should have normalized by now. However, search volatility is still off the charts.

Volatility means links are pinging around between top five organic placements or, sometimes, falling outside the top 20. Even basic searches like “Weather today” are not returning stable results.

But doesn’t that mean somebody else wins, even if one link drops from a top spot to the second page?

On the WebmasterWorld forum, which, unsurprisingly, is heated about Google’s search volatility, many site operators say big-name sites now consolidate the top Google spots (akin to how indie apps no longer break into the App Store’s top charts).

Co-Viewing Conundrum

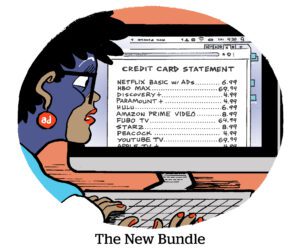

Speaking of Google, YouTube postponed its plans to transact on its own co-viewing numbers.

In August, YouTube told clients that, starting in January, it would bill some video inventory based on its co-viewing numbers. Now it’s pushing that start date to Q4 next year, agency buyers tell Digiday.

The reason? Buy-side backlash.

Advertisers want access to more co-viewing data in streaming ads, but they don’t like it when programmers inflate ratings by fusing their own viewership data with measurement providers. Case in point: Amazon’s and Nielsen’s symbiotic-competitive Thursday Night Football ratings.

Buyers also say YouTube’s plan contradicts its stance on fair third-party measurement standards, although YouTube says it will still let advertisers negotiate guarantees based on Nielsen or Comscore ratings.

Most importantly, though, agencies say co-viewing measurement isn’t reliable enough to determine what ads should cost. Even with panel-based data science, it’s nearly impossible to guarantee who within a household was in the room or paying attention when an ad ran.

Which is why buyers believe co-viewing numbers can work for planning and measurement, not as a currency – at least for now.

Merger Disagreement

It’s hard out there for M&A.

The latest news is that Adobe scrapped its $20 billion deal to acquire design platform Figma.

Adobe sees no way to overcome antitrust opposition by the UK’s CMA, the European Commission and the US DOJ, Bloomberg reports. It will pay Figma a $1 billion termination fee.

Adobe is known for desktop design software like Photoshop and Illustrator. Figma, meanwhile, offers similar web-based design tools. Regulators reportedly saw the deal as an incumbent looking to quash a challenger that had taken market share in an emerging channel. Figma especially raised eyebrows because Adobe doubled the existing valuation.

Adobe’s scuttled deal is the latest indication that regulators now place greater scrutiny on tech sector mergers. Back in May, Meta was forced to sell GIF search engine Giphy to Shutterstock on the CMA’s order. Microsoft’s deal to acquire Activision Blizzard was held up over competitive concerns, forcing Microsoft to sell off UK cloud gaming rights to Ubisoft.

What happens when the strategics aren’t allowed to make acquisitions anymore?

But Wait, There’s More!

Debating the decline of linear TV advertising and pathways to growth. [Madison and Wall]

Disney is a language. Do we still speak it? [The New York Times]

Advertisers struggled to reach Q4 sales goals, stymied by ad softness and macroeconomic uncertainty. [Adweek]

The holdcos strike back: A history of ad tech. [Digiday]

You’re Hired!

Innovid names Dani Cushion as CMO. [release]