The track record of publishers branching out into ad tech is mixed.

Future believes its new monetization offering can succeed where other publishers have struggled with selling ad tech and consulting to third parties.

The UK-based media holding company – which counts over 200 pubs in its portfolio, including Tom’s Guide, Marie Claire, PC Gamer and Guitar World – launched a new suite of services today called Future Elevate. The offering aims to help third-party publishers earn more ad revenue.

In recent years, Future licensed an older version of the product to third-party publisher partners, in addition to using it for its own portfolio, said Nicholas Flood, director of global ad product and revenue operations. The underlying tech was built using the RAMP ad tech stack Future inherited after acquiring publisher ad network Purch’s consumer business in 2018.

But Future Elevate is a risky bet. Other major publishers, such as The Washington Post and Vox Media, have had spotty records offering similar services, ending with discontinued third-party offerings.

But Future believes it has a few differentiators in its favor, Flood said.

Keeping it premium

First, it’s betting on its own track record using the programmatic tech the product was built on, plus the years of institutional monetization experience it added through the Purch deal. It’s also banking on its ability to bring incremental programmatic demand to publishers that might not have the sales teams or programmatic know-how to access it.

But Future is also keeping its expectations in check and setting realistic – rather than overly ambitious – goals, Flood added. “I don’t want 1,000 clients,” he said. “That’d be lovely, but that’s not the game we’re playing.”

Future has kept its circle of clients tight in the pre-launch phase. Thus far, fewer than 10 third-party publishers have used Elevate, Flood said.

And the company intends to continue being picky about who it partners with now that the solution is generally available.

“We’re after premium publishers that have great content written by humans in brand-safe environments that our partners would want to monetize,” he said. As far as audience scale, Future is looking at publishers in the range of 2 to 10 million monthly active users. Smaller publishers need not apply.

What’s in the suite?

Publishers that adopt Elevate will receive Future’s service in audience growth, ad revenue growth, operational efficiency and guidance on regulations like GDPR (which it has experience navigating in its EU-based portfolio) and US state privacy laws.

The audience growth piece is a consultative service based on the publisher’s preference for how they’d like to grow, Flood said. But Future is not interested in pursuing it through paid traffic sources, he added, which isn’t surprising, considering the MFA scare has given paid traffic a bad name.

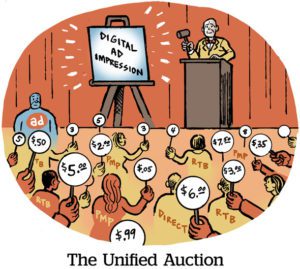

On the ad revenue side, Future brings to bear its Hybrid ad tech platform, which was built using Purch’s RAMP tech. It includes header-bidding optimization and features for boosting yield from display and affiliate inventory.

“What we’re particularly good at is driving revenue through placement of ads and promoting best practices to [publishers] that don’t have the skill set or staff to deliver that,” Flood said.

For example, Future is constantly running tests on its owned and operated properties to assess the impacts of ad load and placement on revenue lift and page load latency, Flood said. Those findings can inform optimization decisions for third-party pubs.

And Future can enrich those findings with behavioral data derived from its audience data platform, which is dubbed Aperture.

Scaling up

The integrations also span both creative and, soon, alternative IDs. The high-performance ad formats Future uses on its own sites – such as homepage takeover units – can run on its partners’ sites.

Future’s sites also integrate The Trade Desk’s UID2, LiveRamp’s RampID and other authenticated traffic solutions, so Future is exploring how to integrate these through Elevate.

Plus, Future can include third-party publishers in campaigns that also run across its network, which reaches 490 million users annually. For that reason, Future is prioritizing publishers with content similar to what its outlets publish. Future sells these cross-network deals directly or programmatically through private marketplaces.

Challenges ahead

But third-party publisher benefits aside, the launch of Elevate is ultimately about propping up a new revenue stream for Future. The company collects a share of revenue from Elevate clients.

Future is doing better than some digital publishers in terms of revenue performance, though its growth rate is somewhat flat. Its revenue in the first half of 2024 was about $499 million, which was down 3% YOY. However, it saw 3% revenue growth in Q2, and the company is optimistic about the second half of the year.

But publisher monetization prospects are dwindling in the face of referral traffic shortfalls from search and social, the slow-moving phaseout of third-party cookies and myriad other challenges. Hence the need for alternative revenue streams.

However, other publishers have had a rough go of licensing tech to third-party media outlets.

The Washington Post stopped licensing its Zeus Prime ad tech product to third-party pubs in December 2022 after three years of trying to make it work as a standalone business.

Vox Media also similarly ramped up ad tech investments by launching a self-serve buying platform in 2020 and turning its ad network of third-party pubs into an SSP in 2022. But in December 2022, Vox stopped licensing its proprietary Chorus CMS to third parties. And last July, it stopped using Chorus entirely.

Future recognizes the challenges its Elevate suite faces, Flood said. Ultimately, whether the offering succeeds depends on if it can guide publishers through the increasingly choppy waters ahead.

“We’re in a good position to navigate ecosystem changes successfully over the next couple of years,” he said. “And we can help our partners do that also.”