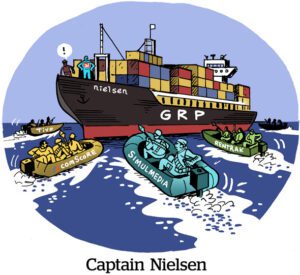

It’s a tumultuous time to be a video currency provider – and, by extension, to be a measurement company like HyphaMetrics that licenses data to currency providers.

New video currencies have been trying for years to topple Nielsen, but grabbing market share from an incumbent is proving more difficult than they thought.

The pressure is leading to leadership shake-ups and strategy changes at currency and TV measurement startups. Nielsen, meanwhile, is suing multiple companies encroaching on its turf, including HyphaMetrics, VideoAmp, TVision, ACRCloud and Innovid-owned TVSquared.

Late last week, HyphaMetrics CEO Chris Wilson stepped down after just a year and a half. Company President Joanna Drews is resuming the role of CEO, which she previously held between 2019, when she co-founded the company, and early 2023 when Wilson took the reins.

Wilson spent nearly seven years at Comscore, including as CRO, before joining Hypha, and will remain as an advisor to the company. Although the details of his departure remain blurred, he posted a cordial farewell on LinkedIn attributing his move to the successful achievement of certain sales goals and milestones.

New beginnings

Sudden leadership changes often suggest some sort of struggle or disagreement related to finances or strategy, as evidenced by the recent reorg at VideoAmp, which included the replacement of its CEO and 20% layoffs.

Rather than trying to become a currency itself, Hypha licenses viewing data from its panel to companies competing in the currency arena, including brands, publishers and currency companies such as VideoAmp, iSpot and Comscore.

The future of HyphaMetrics is therefore tied, at least in part, to the success of alternative currencies.

Still, HyphaMetrics has reasons to be optimistic about its future, and Drews is confident about its place in the measurement space.

The leadership change positions the company for growth, Drews told AdExchanger after Wilson announced his resignation.

While Drews was president, for example, she led commercialization efforts, including applying market feedback to new products. Back in the CEO seat, she’s now well equipped to streamline operations and client growth, she said.

HyphaMetrics also appointed media and entertainment vet Brian Norris, EVP and CRO of E.W. Scripps, as a board director last week. Norris also spent 5 years at NBCUniversal and 10 years at Dish.

Plus, HyphaMetrics recently freed itself from having to deal with a patent infringement lawsuit filed against it by Nielsen in 2021 involving tech that detects whether TV sets are on or off.

Nielsen voluntarily and quietly dropped its complaint last month, which an observer may assume could be a sign that it lacked sufficient evidence to prove infringement. Update: Nielsen denied a lack of evidence was its reason for dropping the case.

Looking on the bright side

Shaking off the lawsuit should help HyphaMetrics on its quest for adoption and also removes an expensive time suck from its to-do list.

“Multiyear lawsuits are a drop in the bucket for an incumbent monopoly, but a huge financial undertaking for a smaller company like us,” Drews said. “It can be a real slowdown.”

Still, she said, the legal drama won’t stand in the way of Hypha’s ambition to work with everyone – Nielsen included.

“We’re more than willing and eager to sell our data to Nielsen, or any currency provider,” Drews said.

And without this lawsuit weighing it down (it’s not the only one Nielsen has filed against the company), HyphaMetrics can put more time and energy into building its business by pursuing new clients.

There’s certainly no shortage of brands, publishers and vendors scrambling for more data to help answer their burning measurement questions.

Changing for sameness

Although leadership has changed, “our plan is the same,” Drews said, which is to license or sell TV viewing data to as many clients as possible.

As to the viability of video currency companies attempting to compete with Nielsen, “I don’t see them as struggling,” Drews said. It takes time to change a system that’s underpinned TV ad buying for decades, she said. Unseating an established player takes a lot of work and an appetite for playing the long game.

In other words, some level of struggle is inevitable. But as a female founder and now the CEO once more of an ad tech company, Drews is no stranger to disrupting the status quo.

And Hypha doesn’t shy away from challenges either, she said.

The company’s strategy and road map are all about trying to solve what remain major head scratchers for the TV industry, including using panel data to accurately measure co-viewing and Spanish-language TV content and to recognize shows at the episode level.

Update 6/27/24: After this story published, Nielsen clarified that it dropped the patent infringement lawsuit in response to HyphaMetrics first agreeing not to use technologies that infringe on Nielsen patents. This agreement is part of redacted court documents that Nielsen said it’s unable to share. A Nielsen spokesperson also told AdExchanger that HyphaMetrics’ agreement was based on an admission that the use of certain technologies would be an infringement.