Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

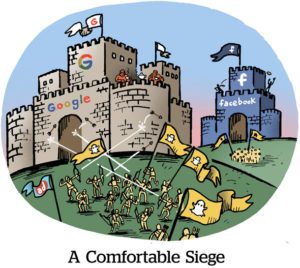

Jury Rigged

Google filed a motion on Thursday requesting that a judge – not a jury – decide whether its ad platform gives it a monopoly over the online advertising industry, as is alleged by the DOJ’s Antitrust Division.

Google argues it would be unprecedented for a jury to decide a federal antitrust trial and that ad tech is too complicated for a jury to grasp and rule on.

The DOJ is seeking damages on behalf of US government agencies that claim they were harmed by anticompetitive fees and manipulated prices while buying $100 million in Google ads since 2019. The Seventh Amendment requires federal civil trials seeking damages be decided by a jury. But Google says that protection only applies to US citizens, not the government.

In an attempt to render the need for a jury trial moot, Google also cut the US government a check “for the full monetary damages it seeks.” We’ll see if that works.

Google has good reason to want to avoid a jury. In December, a jury ruled against Google in the Epic Games antitrust case against the Google Play Store. A similar antitrust suit against Apple’s App Store had a judge rule almost entirely in Apple’s favor.

Google has also been burned badly by the disclosure of internal comms and private memos in recent antitrust suits, so it’s strongly incentivized to nip this case in the bud.

The “Mart” In Smart

Walmart, which reported earnings last week, is the bellwether in a trend of retailers investing heavily in advertising, in-store pickup and other ecommerce services as a way to fortify their profit margin. In finance parlance, retail is shifting from investing almost entirely in operating expenses (such as wages for associates and product discounts) to focusing more on capital expenditures (as in automation and information services).

During Walmart’s earnings call, one investor, Robert Ohmes from Bank of America, asked how the company manages to improve profit margins while reporting price deflation.

“How are you doing that?” he said. “Is it really just the advertising [and] marketplace fulfillment and all those things are helping the gross margin so much that it’s more than offsetting core gross margin weakness?”

John Rainey, Walmart CFO, said he likes to look at profit margin per incremental new revenue. For every net new ecommerce and advertising dollar, Walmart earns 12.5% – roughly three times its overall margin – and that keeps on improving as the ecommerce supply chain matures.

“There’s not, to me, a more compelling data point that supports the strategy that we have,” Rainey said. “That’s changing the margin profile of our business going forward.”

TikTok Takes On TV

While TikTok parent company ByteDance and the US government hash it out in court, TikTok is still going after YouTube.

TikTok is testing 60-minute video uploads, although this is currently limited to a small group of users, TechCrunch reports.

The purpose, no doubt, is to give creators who already post long videos on YouTube a way to easily repost their content on TikTok.

This test isn’t TikTok’s first foray into long-form content. In 2022, it released an eight-episode docuseries viewers could pay to watch.

But 60-minute account uploads could also mean TV networks might distribute their IP on TikTok, just like they do on YouTube, Mike Shields writes on Substack. The road to TV ad dollars is paved via distribution.

“We have a lot of conversations [with] traditional TV buyers,” Tim Natividad, TikTok’s head of enterprise sales, tells Shields. TV advertisers, Natividad says, are starting to recognize that there’s a large incremental audience accessible on TikTok.

But Wait, There’s More!

Fox’s ad chief shares expectations for next year’s Super Bowl. [Adweek]

X is now X.com. RIP Twitter. [The Verge]

Under a new partnership, Reddit will license its content to ChatGPT, while OpenAI will advertise on Reddit and provide it with AI tools. [release]

Google’s generative search products, which are terrible, are taking over Search pages. [aftermath]

Surviving the SEO shake-up: Publishers vs. Google’s new game. [AdMonsters]