So, you found out you’re not a premium publisher.

As everyone in digital advertising has heard by now, The Trade Desk recently ranked the top 100 publishers on the open web.

The list followed the beta launch of a product called SP500+ (“SP” meaning sellers and publishers), which is a group of about 500 premium media sellers the demand-side platform has aggregated. This is part of a broader effort from The Trade Desk, the self-proclaimed champion of the open internet, to connect the buy side with “the premium internet.”

But who gets to decide what is premium? Is it dangerous to outsource that decision to The Trade Desk (or any one DSP)? And what should publishers be considering as they position themselves within the future of this so-called premium internet?

Crowning the arbiter of premium

Publishers have been saying since the dawn of programmatic that they need to band together to enable scale for advertisers and compete with the walled gardens. It’s logical that premium publishers would unite and collectively increase the value and accessibility of their inventory.

Now, The Trade Desk is essentially saying, “We’ll draw those lines for you.” If publishers can’t band together on their own, an intermediary that primarily serves advertisers, not publishers, is stepping in to do the job.

But The Trade Desk’s move undermines the very thing publishers are supposed to band together to prevent: a tech platform taking control of digital advertising and publishers’ valuable inventory and audiences. And with that power comes the ability to set prices and deal terms, determine which buyers get access to inventory and which publishers are in and which are out.

If the premium internet is to thrive, a DSP shouldn’t be the arbiter of premium publishing. Publishers should be. But, ultimately, money talks. Buyers decide what’s premium and what isn’t.

Programmatic isn’t the only premium option

The threat to buyers’ and publishers’ autonomy isn’t the only reason it’s concerning that a DSP is becoming the arbiter of premium publishing. Another concern is the prioritization of programmatic and proprietary cross-publisher IDs that could accompany such a move.

The Trade Desk has a vested interest in propping up publishers that sell through them programmatically. It also has an interest in compelling publishers to adopt UID2, a proprietary post-cookie reinvention of cross-publisher identifiers that could play into the same commoditization of publisher inventory that the open market precipitated.

Under The Trade Desk’s dominion, what happens to publishers that don’t want to adopt alternative IDs or prefer to sell the vast majority of their inventory directly? Will those publishers get a fair shake?

The future is direct

The future of premium publishing and advertising should not be dominated by any one tech platform, intermediary or ID. Nor should it be led by programmatic, which provides value for selling remnant inventory but was never the ideal vehicle for selling the majority of a premium publisher’s inventory.

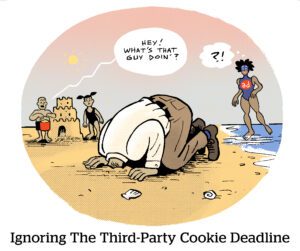

The future of advertising will center on direct deals – and The Trade Desk recognizes that. With the death of the third-party cookie, the advertising industry is shifting from selling audiences to selling premium media environments, which are disproportionately home to high-value, logged-in audiences.

The question is: Who will be the gatekeeper to those increasingly valuable environments? Will it be a tech intermediary that primarily serves buyers, recreating the digital publishing woes of the past two decades marked by the ascendency of programmatic? Or will it be publishers?

To take control of this next chapter of their history, publishers need to hold the keys to their own inventory. They need to band together. And they should collectively foster more direct relationships with advertisers.

If they don’t, someone else will do it for them.

“The Sell Sider” is a column written by the sell side of the digital media community.

Follow FatTail and AdExchanger on LinkedIn.

For more articles featuring Doug Huntington, click here.