There is an old adage in consumer electronics that the hardware business, with its tight margins and fickle consumers, is, well, a hard business. To think that Walmart decided to invest billions of dollars into building and selling TVs faster, better and/or cheaper than Vizio misses the point of the acquisition last week.

While Walmart might marginally improve production or distribution efficiencies for Vizio, a TV’s future value will increasingly be measured against the seven years it spends at the center of today’s modern connected home – not its initial retail price.

The clear rationale for the Vizio acquisition is TV and video advertising. And as advertising takes center stage, its value is directly linked to the underlying data that supports it. Data has not only become the new oil for marketers; it is also the oxygen breathing life into TV advertising with new branding and performance opportunities.

A proven data strategy

America’s largest retailer has long been an early adopter of using the type of data that Vizio offers.

Already, many agencies and brands rely on Vizio’s data, and it’s licensed by virtually every company competing for TV audience currency supremacy. But for a glimpse at how Walmart might apply Vizio’s TV data set to accelerate its own advertising business, we need only to look to the past.

In the ’90s, Walmart’s shopping data became a critical component of Nielsen’s CPG tracking business, with the retailer licensing its data for both tracking and analytics. As the value of this and other proprietary insights advanced, Walmart ended its licensing agreement, recognizing that it could generate more value (and thus revenue) by using its data internally and working directly with manufacturers.

The company also famously analyzed data to identify products with the greatest increases in sales velocity during natural disasters. The winner? Everyone’s favorite tasty treat, Pop-Tarts – a product with a long shelf life that can be eaten cold. Beyond that, Walmart uses its data on an ongoing basis to develop in-store pricing and promotion strategies, improve store stocking configuration formats, identify categories for private-label products and so much more. And now with Vizio’s viewing data, there’s more opportunity than ever.

Now, history looks as if it may be poised to once again repeat.

Walmart’s Vizio ambition is to fulfill the ask of every marketer: deterministic attribution at scale. In other words, link household-level impression data to transaction data in a fully closed-loop model.

Those believing that Walmart would continue to act as a data broker and license Vizio viewing statistics broadly are missing the point. Walmart generates more than $1B in retail sales daily. Vizio data deals sum to only low nine figures.

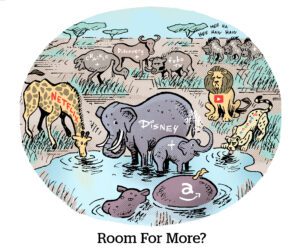

Walmart wants more access to the $300B-plus digital advertising market. Pulling Vizio data into Walmart’s garden enables massive advertising growth, far surpassing the data licensing opportunities.

To put this into context, the overall advertising opportunity is so big for Walmart that its CFO recently stated: “More of [our] future profitability is likely to come from selling ads on Walmart properties than by selling everyday essentials.”

Fueling innovation and growth

Walmart’s goal is assumed to be similar to Amazon’s efforts to expand its advertising business through Prime Video.

Jeff Bezos opined in 2016 that winning a Golden Globe was valuable because it helped accelerate Amazon’s flywheel and deepen connectivity to its retail side by “helping it sell more shoes.” Likewise, the Vizio transaction is about building much deeper inroads into household consumer engagement that will ultimately strengthen Walmart’s retail hand and open new revenue streams in advertising. And once that flywheel is set in motion, it’s proven to drive success.

In the near term, TV audience measurement companies will scramble for access to a shrinking pool of available viewing data. One could argue that, for measurement companies, a more restricted data market would help players who have focused/are focusing on proprietary, first-party data, including companies like Nielsen, TVision and disruptor Telly, whose data business could well be as important as its ad business.

In the end, Walmart’s Vizio acquisition serves as a powerful validation that the broader TV and video advertising market is undergoing much-needed innovation poised to unleash a new wave of data-fueled growth.

“On TV & Video” is a column exploring opportunities and challenges in advanced TV and video.

Follow Andy Brown and AdExchanger on LinkedIn.