Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

SPO M&A

The Cannes Lions festival is always a splashy week, and this year the much-derided SSP category found itself in the middle of the action.

On Friday, Adweek reported that Sonobi is up for sale – it has been for sale since September, in fact. And Adweek reported that 33Across, an SSP and publisher monetization solution, is up for sale as well, also for several months.

And that’s not to mention the SSP Verve, which acquired Jun Group, another supply-side ad business, for $185 million.

What’s the deal? The SSP category is said to be withering and consolidating down to a few big names.

Well, for one thing, consolidation is part of it. Verve acquired Jun Group because most SSPs need more scale than ever to get by. It’s also trying to shed the “SSP” label in favor of “omnichannel platform” status.

As one anonymous consultant tells Adweek, there’s a big drop-off in market share in the SSP category after the likes of Google, Magnite, PubMatic and Index Exchange. M&A could give smaller players a fighting chance.

The Upfront Stakes

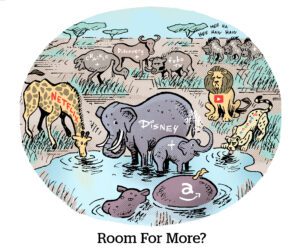

Disney is going aggro in upfront negotiations, and it’s ruffling other programmers’ feathers, Variety reports.

To secure additional streaming ad dollars, Disney is implementing rollbacks, which means it’s reducing prices by as much as 10%-15%, execs say. In response, NBCUniversal also rolled back its CPMs to compete with Disney. Competitive pricing is helping these two gain traction with brands in their negotiations so far, according to ad execs.

Meanwhile, Warner Bros. Discovery, Netflix and Prime Video are all resisting lower CPMs. Though not just out of stubbornness. Rollbacks can take years to reverse, in part because they undermine further justifications for raising ad prices.

But playing the long game comes with its own risks. Amazon and Netflix have especially high CPMs compared to TV programmers, but also less demand than they expected, with the exception of Thursday Night Football, Variety reports.

WBD is also clinging to high CPMs, but losing headway with brands that it desperately needs, all while its revenue is plummeting.

We’ll see who ends up on top – or digs their way out of the bottom with lower rates.

It’s Complicated

Dating apps are in a rough patch.

They’re dealing with bounceback from growth expectations set during mass quarantines of 2020 and 2021, when people weren’t meeting in real life. Plus, Apple’s ATT makes user acquisition more expensive.

Also, dating apps seem to have missed the mark in their marketing, The Wall Street Journal reports.

Their recent campaigns offer plenty of out-of-touch messaging: “Ick-inducing” ads for elite, ambitious individuals (“Be a Goaldigger,” says one); Bumble joking at the expense of women frustrated with online dating; and Hinge campaigns about being “Designed to be Deleted” that ring differently for people who’ve spent years using the service.

Dating apps are also under ad revenue pressure. They broker data to third parties for advertising and have in-app marketing. But it’s harder for a dating app to start an ad platform business compared to, say, Uber, Etsy or Marriott.

Dating app data is particularly personal. A go-to example of the perils of third-party data brokers is Grindr data being de-anonymized to identify individuals who haven’t come out yet.

How can dating apps market their way out of the hole?

“We know that our best growth comes from organic success stories of people meeting on [our app],” says Hinge CMO Jackie Jantos.

But Wait, There’s More!

YouTube will ask iOS users to ‘Allow’ tracking for more personalized ads. [9to5Google]

OpenAI acquires the search and analytics startup Rockset. [The Information]

Cindy Gallop says some Cannes Glass Lions awards nominees were notified afterward of sexist behavior during their presentations. [Ad Age]

Hard truths during the most difficult moment ever for media companies. [Axios]