Verve strikes again.

This time, Verve, the mobile ad tech holding company (which until recently went by Verve Group), snapped up Jun Group, a mobile video and gaming ad business, for $185 million, the companies announced on Tuesday.

It was a fortuitous deal for Verve. Advantage Solutions, the commerce tech company that owned Jun Group, has been selling off digital advertising businesses like crazy.

And while Jun Group, like Verve, is an in-app advertising business, it brings a different set of mobile publishers, with larger game developers like Zynga and Scopely.

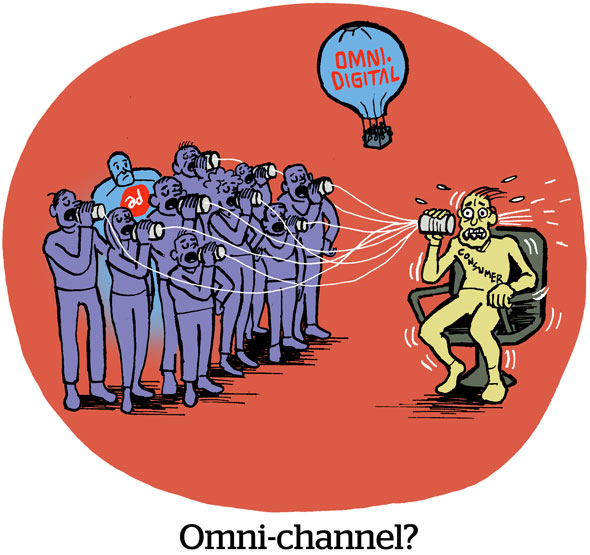

What this deal comes down to for Verve, though: “We want to be an omnichannel platform in the coming few years,” CEO Sameer Sondhi told AdExchanger.

Going omni

Verve’s edge has always been its mobile SDK network and ad tech stack. But in the past few years, the company has made a concerted effort to shift from being a mobile specialist SSP to an omnichannel platform.

On the supply side, Verve’s omnichannel focus means trying to grow its “emerging channels,” Sondhi said, including audio ads, digital out-of-home, CTV and in-app gaming videos or other rich media, as with Jun Group.

In 2021, Verve acquired LKQD from Nexstar, its first major foray into CTV.

But becoming an omnichannel platform also means growing Verve’s demand-side presence, not just supporting any medium or format that can be traded programmatically. For instance, Verve acquired the mobile DSP Dataseat in 2022 and almost acquired MediaMath last year.

With Jun Group, Verve has many clients in common among its mobile game developers, Sondhi said. “[But] on the brand and the agency side of the business, there is very little overlap.”

Rather than making acquisitions simply to grow its SDK footprint, Verve is now looking to reach new kinds of marketers, like those that do entertainment and upper-funnel branding.

Yes we Cannes

Verve made a major attempt to grow its demand-side business by acquisition last year, too. It followed up a relatively small deal for Dataseat with an ill-fated attempt to acquire MediaMath.

Verve has also now made a string of deals during or just after the Cannes festival. Aside from the MediaMath fiasco last year, Dataseat and Smaato were both acquired in early July in 2022 and 2021.

This week’s acquisition was “some time in the making,” Sondhi said. (And the others weren’t scheduled around the conference circuit, he added.)

It takes time for the deals to happen and for the business synergies to start to click, he said.

But, in a few years, he wants Verve to be a far more diversified platform.

“Omnichannel is the way to go,” he said. “We’re not there yet, to be honest, (but) it’s going to happen sometime soon.”