Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

The Big Squeeze

Temu will open its marketplace to US third-party sellers, which could spell trouble for struggling marketplaces like Etsy and Wayfair, The Wall Street Journal reports.

Etsy and Wayfair aren’t known for quick shipping, like Amazon and Instacart, so they’re susceptible to Temu, which also ships quickly. Etsy’s custom goods – sometimes one-off creations crafted by makers – take time, and Wayfair’s furniture is larger and more burdensome to ship.

Temu is also outdoing its competition with (seemingly) endless media spend. Not to mention that it charges lower seller fees than Etsy or Wayfair and offers higher affiliate incentives.

In December, Etsy’s CEO said the company won’t get into a media buying war with Temu. (Don’t fight a battle you’ll lose.) Instead, Etsy “will bid rationally” for ads and hopefully survive Temu’s deluge.

After all, Temu has a challenge, too. American product sellers won’t offer the same plastic garbage at unbelievably low prices. If US third-party sellers sell on Temu, they’ll likely do so at more normal prices.

And so the race is on. Etsy and Wayfair must outlast Pinduoduo, the Chinese company that owns Temu, which in turn will eventually lose its appetite for burning billions of dollars per year … right?

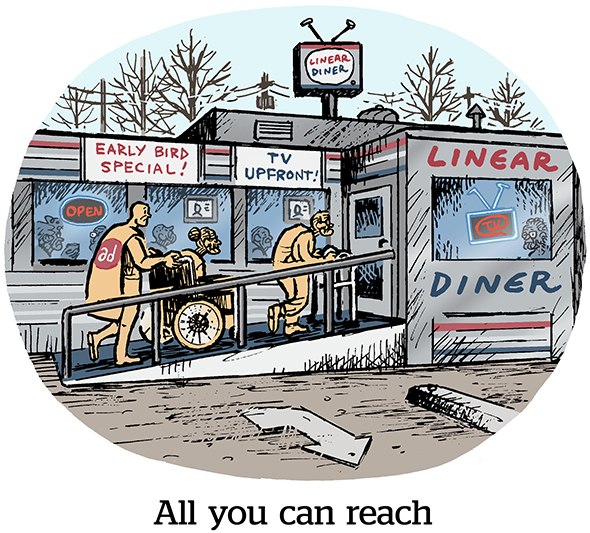

Upfront And Personal

The ad industry’s obsession with audience data is changing the look and feel of the TV upfronts.

Whereas advertisers used to base upfront commitments on a programmer’s content slate, the shows themselves are now almost an afterthought compared to audience data, Ad Age reports. One anonymous media buyer says 100% of client investment is audience-based, including age/gender demos for traditional TV.

But, the buyer says, “we’re watching closely on if [the TV industry] has gone too far” into audience-based buying.

And this isn’t exactly an ask-and-ye-shall-receive situation. Basic demos don’t return much intel about campaign performance, hence demands for show-level transparency – but that data has not been forthcoming.

Zeroing in on audiences above all else also disregards inventory quality. As much as YouTube and TikTok insist that short-form, user-generated content can be “premium,” it’s fundamentally different from episodic content and high-profile tentpole events.

Still, buyers are dead set on executing more of their upfront budgets programmatically, and the pendulum is starting to swing. Demand-side platforms, for example, now offer additional audience data and also allow buyers flexibility to shift spend based on what works (or doesn’t) in a campaign media mix.

Which is to say, expect audience data and programmatic buying to dictate this year’s negotiations.

The Food Chains

The FTC is suing to block the merger of Kroger and Albertsons.

As with the AT&T/Time Warner deal – also opposed by the FTC, which later lost in court – this is another corporate mega-merger with huge potential implications for ad tech, despite the fact that ad tech has no bearing on the case itself.

In other words, the FTC is standing in the way of a massive combined retail media network.

Kroger and Albertsons maintain that blocking the merger actually prevents competition. They might not seem like the little guys, but the two grocery chains believe their merger is necessary to compete with Amazon and Walmart, which are already so much bigger and outgrowing the competition by leaps and bounds.

Another rationale for blocking the deal is that it heavily benefits Cerberus, the private equity firm that took over debt-laden Albertsons and then loaded the biz with more debt to pay its execs.

Cerberus, BTW, is pretty much the only company that profited off of Sizmek’s fire sale to Amazon in 2019. It owned the debt and took over Sizmek after the original PE firm owner Vector Capital gave up on its turnaround plans for the company.

But Wait, There’s More!

The IAB Tech Lab introduces initial OpenRTB support for the Protected Audience API within Google’s Privacy Sandbox. [blog]

The Supreme Court will hear arguments regarding state laws that prohibit social media censorship. [The New York Times]

Advertisers feel the frustration as Meta replaces account executives with AI chatbots. [Digiday]

Meanwhile, Meta has reportedly demoted images and content related to the Israel-Hamas war. [The Markup]

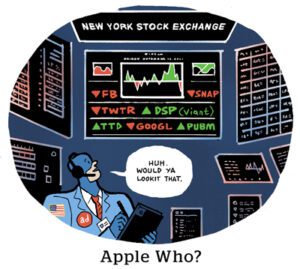

Microsoft blames Google for its failed attempt to sell the Bing search engine to Apple in 2018. [Search Engine Land]

Disney+ is raising the price of its ad-free tier (again) for European subscribers. [h/t @SimonJHarris]