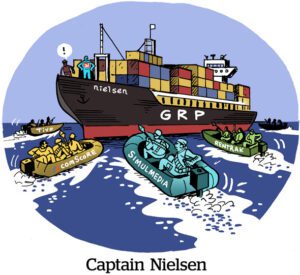

Most of the companies in the digital marketing ecosystem have traditionally serviced either the supply or the demand side.

But in the last few years, this trend has started to change. Google and Meta have always served both sides of the advertising ecosystem, and other examples are emerging as well.

In 2022, leading demand-side platform (DSP) The Trade Desk announced the launch of OpenPath, which enables advertisers to directly connect with premium publishers, circumventing Google Open Bidding and potentially supply-side platforms (SSPs).

In 2023, Yahoo’s Backstage DSP also started enabling marketers to buy directly from the top 10% of publishers.

SSPs Magnite and PubMatic announced solutions that enable bypassing DSPs to purchase CTV video ads in 2023.

These offerings were launched to increase transparency, efficiency and cost savings; reduce fraud; and increase revenue. But there are other motivating factors for crossing the LUMAscape, too.

These businesses are trying to position themselves to win in a transformative era that will make or break many ad tech companies.

More data

It’s not a coincidence that The Trade Desk launched OpenPath less than a year after Apple introduced its AppTrackingTransparency initiative and started requiring users to consent to advertisers accessing their IDFA mobile ad IDs.

App marketers, which are now most marketers, lost critical data signals on Apple devices (and would subsequently lose data signals on Android, too). With GDPR-like privacy legislation crossing the Atlantic, ad tech vendors wanted to ensure they have access to as much data as possible.

For a DSP like The Trade Desk, working directly with publishers provides more contextual data signals and additional click-through funnel data.

For SSPs, gaining access to direct advertisers also provides client data at a greater scale than when they worked exclusively through DSPs, as well as a better understanding of advertiser KPIs.

Big Tech regulation fallout

DSPs and SSPs are also attempting to better position their organizations for the potential regulatory fallout resulting from the legal battles facing Big Tech – most notably, Google.

Last year, the Department of Justice (DOJ) filed suit alleging that Google runs a monopoly in digital advertising. The DOJ is seeking to force the sale or spinoff of the Google Ad Manager suite, which includes Google’s publisher ad server, and AdX, the company’s ad exchange. In 2020, a lawsuit was filed against Google led by the Texas Attorney General alleging anti-competitive practices.

Though it could take years for these cases to play out in court, Google might decide to strategically divest parts of its ad tech business to resolve these suits without a protracted legal battle.

With The Trade Desk’s OpenPath offering, it would be a more attractive option for publishers seeking a supply-side partner if Google divests its Google Ad Manager. And as a DSP, The Trade Desk could help these publishers monetize their traffic.

For Magnite, PubMatic and other SSPs, divesting Google Ad Manager could add scale from publishers seeking a new alternative, though it’s unclear how they’d benefit from their direct relationships with CTV advertisers unless YouTube advertising is part of the divestiture.

Disintermediation

While there has been talk about streamlining the supply chain for years, it’s easier to implement these changes now. Since the end of the pandemic, there has been an increase in talk about consolidation in the ad tech industry. With VCs less interested in funding ad tech companies and interest rates at 15-year highs, companies with cash flow issues are more vulnerable than ever. Ad tech vendors will need to prove their value in the supply chain or be forced to merge, get acquired or close.

The result could bring the coveted promise of supply-chain optimization. If vendors in the supply chain are eliminated, the likelihood of fraud or malware decreases. Eliminating vendors also reduces costs as there are fewer companies billing. This should reduce costs for advertisers and increase revenue for publishers and app developers.

With the well-documented challenges that publishers have been facing since the rise of digital publishing, we as an industry need to work to ensure that publishers earn sufficient revenue to survive. There are already many small and midsize markets with no local news organizations. If marketers want to be sure that they have publishers to advertise in, they need to support publishers equitably.

The future will bring more DSPs and SSPs reaching out to work directly with publishers and advertisers. There’s no turning back the clock.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Follow BRAVE and AdExchanger on LinkedIn.