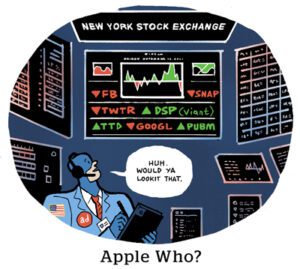

DoubleVerify is bullish on social.

How bullish? “We expect customer adoption of DV solutions across social media to fuel revenue growth for years to come,” CEO Mark Zagorski told investors on the company’s earnings call on Wednesday.

Social media measurement rose 62% in the fourth quarter compared to Q4 2022. The category now accounts for 43% of DV’s measurement venue (which grew 25% to $198 million) and 15% of DV’s total revenue in 2023.

And as DV sees it, social still has plenty of room to grow.

For instance, roughly half of DV’s top 100 customers currently use the company for measurement on Meta, whereas more than 90% of them use DV for YouTube, according to Zagorski. Those YouTube advertisers are probably on Meta, too; they just aren’t using DV tech there.

In the first quarter, DV released its third-party brand suitability verification for Facebook and Instagram feeds and Reels, and there was 51% growth in impression volume. Doing some quick mental math, Zagorski estimated that, since Meta comprised about 7% of DV’s revenue last year, or close to $40 million, on its current growth trajectory with Facebook and Instagram, DV could generate an incremental $20 million in revenue for 2024.

TikTok also presents a “large growth opportunity,” said CFO Nicola Allais. They’re only just expanding beyond English-language campaigns.

DV is also riding the wave of short-form video consumption, which Zagorski said demands AI investments (can’t forget to cite AI in an investor call nowadays). To that end, it bulked up its employee count from 902 at the close of 2022 to 1,101 at the end of 2023. “Nearly half of our headcount growth was attributable to R&D,” Zagorski said.

The big picture

Aside from measurement, DV has two other lines of business. Activation revenue, which refers to DV’s brand safety and suitability products, grew 31% YOY to $328.9 million. Meanwhile, supply-side revenue – which, at $45.6 million, accounted for less than 8% of total 2023 revenue – grew only 5%.

A handful of CTV and retail clients had a slow start to the year, but DV expects that revenue will ramp up from both them and new clients in the latter half of the year, which could provide a much-needed boost to the supply-side business.

Monolith no more

DV also touched upon a tiered MFA classification tool it launched earlier this month. Advertisers often take a “meat cleaver” approach to blocking MFA inventory. That cleaver harms publishers, including “marginalized publishers who are being excluded from media buys,” Zagorski said.

The same applies to filtering out misinformation, disinformation, inflammatory content and hate speech when, say, placing ads next to user-generated videos. During this election season, particularly with highly competitive races, there’s a higher incidence of so-called news that most brands wouldn’t want to appear next to, Zagorski said.

“We don’t see it as a category on its own that’s going to drive business for us,” Zagorski said of DV’s MFA and news filtering tech. “We think it is just another value add that our solution provides that makes us sticky with our customers.”