Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

The Sandbox Soapbox

The Trade Desk and other ad tech companies (not to mention the IAB Tech Lab) have been antagonistic to the Chrome Privacy Sandbox.

Which has opened a wide lane for Criteo to establish itself as the largest and most heavily invested vendor in the Privacy Sandbox – but it’s a very complicated balancing act and one with serious unknowns.

Criteo says it’s got around 50 engineers working on its Privacy Sandbox products and has spent in the low millions developing related tech, Digiday reports. That’s a high cost to bear if Google ends up balking on third-party cookie removal – or, more likely, is stymied by the UK’s competition regulator.

And who knows, perhaps alternative IDs and products like data clean rooms will mature to the point that the Chrome Privacy Sandbox never reaches a critical mass of adoption.

On the other hand, if ad tech companies don’t invest and Google does deprecate third-party cookies, vendors risk being outperformed on Chrome. (Or they’ll just license Criteo’s tech, is Criteo’s idea.)

So the Privacy Sandbox could be a strong prospecting funnel for vendors if/when marketers embrace post-cookie solutions – or vendors may just end up eating sand.

An Open Question

The open web is in trouble. And publishers, advertisers and ad tech companies are in denial about the revenue losses that will accompany third-party cookie deprecation, Eric Seufert writes at Mobile Dev Memo.

The Privacy Sandbox APIs are a far cry from cookie replacements, and Chrome isn’t even promising a replacement, only something new that approximates the same use cases.

Alternative IDs, which Google Ads and Chrome have said won’t be sustainable long term, also can’t measure up to cookies. Most alt IDs depend on users to provide their email addresses to publishers across multiple websites, which isn’t feasible at scale.

But hope springs eternal. Some brands and publishers believe the open web is too important to degrade or fade into irrelevance.

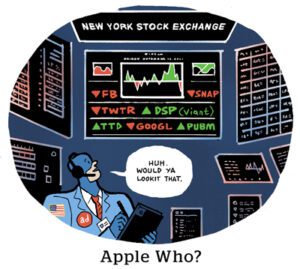

The truth is, however, that the open web is replaceable. Social media platforms and other walled gardens, CTV channels and retail media networks are already huge and keen to grow. Even The Trade Desk, which is the second largest DSP behind Google, looks a little piddly in comparison.

“The economy of the open web, empowered through third-party cookies, is not too big to let fail,” Seufert writes. “Participants in the open web seem to be whistling past the graveyard in the face of third-party cookie deprecation.”

Go Big, Go Small

Amazon has developed its ad tech biz to the point where it’s ready to take on Google and Meta, Business Insider reports, and it’s got a couple of different growth levers to pull.

One is to increase average ad spend as a percent of sales on Amazon.

Not so long ago, the average Amazon seller was investing about 8% of sales back into Amazon ads, says Mark Power, CEO of Amazon consultancy Podean. Nowadays it’s likelier between 12% and 15%.

The other way to grow is to add new brands. Despite Amazon’s meteoric ad revenue growth, it’s actually still missing large customer groups that already spend big on Google and Meta. Amazon is working hard on SMB and local advertiser products to help attract the every-businesses (barbers, mechanics, electricians, dentists, etc.) that fill Google’s and Meta’s respective ad platforms with demand in every nook and corner of the country.

And Amazon is also missing the other end of the barbell. Big-name brands, like the top-selling CPGs in the world, aren’t big on Amazon. Hershey’s and Coca-Cola, for example, simply don’t sell that much on Amazon’s platform or in Whole Foods – at least relative to how much they sell in Kroger or Walmart stores.

But Wait, There’s More!

Putting the audience first in the publishing world. [The Rebooting]

Automakers are sharing consumer driving data with car insurers. [NYT]

Apple makes further concessions to app developers in Europe. [WSJ]

Attention firm Adelaide penetrates holding company media agencies with a new planning tool. [Digiday]

Retail optimization platform Threecolts acquires Marketplace Pulse, an ecommerce market research business and industry pub. [release]

You’re Hired!

The Media Rating Council names Hannah Bolcar as director of measurement audit operations. [MediaPost]